Expert Insights: What You Required to Know About Credit Repair Providers

Expert Insights: What You Required to Know About Credit Repair Providers

Blog Article

A Comprehensive Guide to Exactly How Credit Rating Fixing Can Change Your Credit Report

Understanding the complexities of credit history repair work is essential for any individual seeking to boost their economic standing. By resolving concerns such as settlement history and credit history usage, individuals can take aggressive actions towards enhancing their debt ratings.

Recognizing Credit Report

Comprehending credit history is important for anyone seeking to improve their economic wellness and gain access to better loaning alternatives. A credit history is a mathematical depiction of a person's creditworthiness, normally varying from 300 to 850. This score is generated based on the information included in a person's credit score record, that includes their debt background, outstanding debts, payment background, and types of credit score accounts.

Lenders utilize credit report to evaluate the threat connected with offering cash or extending credit scores. Greater scores indicate lower danger, frequently leading to extra desirable loan terms, such as reduced rates of interest and higher credit scores limitations. Conversely, lower credit report can cause higher rates of interest or rejection of credit scores entirely.

Numerous elements affect debt ratings, including settlement history, which accounts for roughly 35% of the rating, followed by credit rating usage (30%), length of credit rating (15%), kinds of credit in operation (10%), and new credit report queries (10%) Understanding these aspects can empower individuals to take workable actions to improve their scores, ultimately improving their economic possibilities and security. Credit Repair.

Typical Credit History Issues

Many people encounter typical credit score problems that can hinder their financial progress and impact their credit ratings. One prevalent issue is late repayments, which can significantly damage credit score rankings. Even a single late repayment can stay on a credit report for numerous years, affecting future loaning possibility.

Identification theft is another major worry, possibly leading to illegal accounts showing up on one's credit score report. Resolving these usual credit concerns is important to enhancing monetary wellness and establishing a solid credit report profile.

The Credit Rating Fixing Process

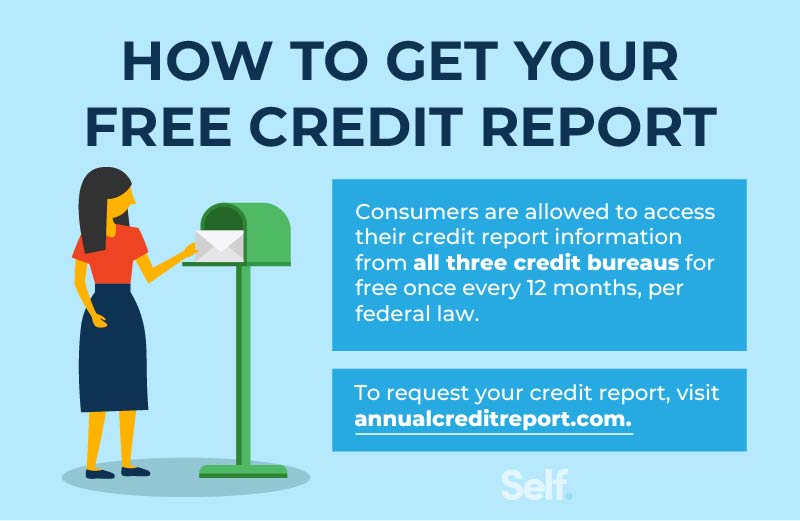

Although credit scores repair service can appear difficult, it is a systematic procedure that people can take on to boost their credit history and remedy errors on their credit rating records. The very first step entails acquiring a copy of your credit history record from the 3 major credit bureaus: Experian, TransUnion, and Equifax. Evaluation these records thoroughly for discrepancies or errors, such as inaccurate account information or outdated info.

Once mistakes are recognized, the following step is to contest these mistakes. This can be done by speaking to the credit history bureaus directly, supplying documentation that sustains your insurance claim. The bureaus are called for to explore conflicts within one month.

Maintaining a constant settlement history and handling credit history usage is also crucial throughout this procedure. Monitoring your credit rating routinely makes certain ongoing accuracy and assists track enhancements over time, strengthening the performance of your credit rating repair service efforts. Credit Repair.

Benefits of Credit Report Repair Service

The advantages of credit fixing prolong much beyond simply enhancing one's credit report; they can considerably influence financial stability and possibilities. By resolving inaccuracies and negative things on a credit history report, individuals can improve their credit reliability, making them much more attractive to lending institutions and economic establishments. This enhancement typically brings about much better rate of interest on lendings, reduced premiums for insurance policy, and boosted chances of approval for charge card and home loans.

In addition, credit scores repair work can assist my blog in access to essential solutions that need a debt check, such as leasing a home or getting an utility service. With a healthier debt account, individuals might experience boosted confidence in their financial decisions, permitting them to make larger purchases or investments that were previously out of reach.

In enhancement to substantial monetary benefits, credit history repair service fosters a feeling of empowerment. People take control of their monetary future by proactively handling their credit scores, bring about even more informed choices and higher financial literacy. Overall, the advantages of credit fixing contribute to a much more stable monetary landscape, eventually advertising lasting economic development and individual success.

Choosing a Credit Scores Fixing Service

Selecting a credit rating fixing service needs cautious factor to consider to ensure that individuals obtain the support they need to improve their monetary standing. Begin by researching prospective firms, focusing on those with favorable customer evaluations and a proven performance history of success. Openness is key; a reliable service needs to clearly outline their processes, timelines, and charges upfront.

Next, confirm that the credit report repair solution adhere to the Debt Repair Organizations Act (CROA) This federal legislation protects customers from misleading techniques and collections standards for credit scores repair solutions. Avoid business that make unrealistic promises, such as guaranteeing a certain rating rise or claiming they can get rid of all negative items from your record.

Additionally, think about the level of consumer assistance supplied. An excellent credit fixing service should give individualized assistance, permitting you to ask inquiries and get prompt updates on your progression. Try to find services that provide a comprehensive evaluation of your credit report and establish a customized method tailored to your specific scenario.

Ultimately, selecting the ideal credit score fixing solution can cause considerable enhancements in your credit history, equipping you to take control of your financial future.

Conclusion

Finally, reliable credit history repair methods can considerably enhance credit report by dealing with usual concerns such as late payments and mistakes. An extensive understanding of credit score aspects, combined with the involvement of credible credit report repair solutions, helps with the arrangement of adverse products and ongoing progression surveillance. Inevitably, the effective improvement of credit report not only leads to much better loan terms yet also fosters higher monetary chances and security, emphasizing the importance of positive credit management.

By addressing problems such as repayment background and debt usage, individuals can take aggressive actions toward improving their credit scores.Lenders use look at more info credit ratings to analyze the site risk linked with providing money or extending credit.Another regular problem is high credit report use, specified as the proportion of existing credit report card balances to complete readily available credit rating.Although credit score repair service can seem daunting, it is an organized process that individuals can take on to enhance their credit report scores and correct inaccuracies on their credit score reports.Following, verify that the credit repair solution complies with the Credit score Repair Service Organizations Act (CROA)

Report this page